Is UniMex Real or Scam? A Deep Dive Into Trust, Security, and Innovation

- Sep 5, 2025

- 3 min read

When it comes to digital finance, one of the biggest questions investors ask is: “Is this project real, or is it a scam?” With so many platforms appearing in the crypto space, it’s natural to be cautious. In this blog, we’ll take a closer look at UniMex, its ecosystem, and what sets it apart to determine its legitimacy and by the end you know Is UniMex Real or Scam?

🌍 What is UniMex?

UniMex is the world’s first TradeFi asset trading platform. Unlike traditional crypto exchanges or DeFi projects, UniMex combines:

Traditional Finance (TradeFi): Bank-grade custody, compliance, and fiat support.

Web3 Innovation: Tokenized assets, staking, liquidity pools, and NFT integration.

Community Ecosystem: Seamless link with UniLive, a social and content platform that brings users into digital finance.

This unique combination makes UniMex a bridge between Web2 and Web3, designed to welcome both beginners and seasoned investors into the digital finance space.

🛡️ 6 Reasons which will make you clear UniMex Real or Scam

1. Backed by a Regulated Bank

UniMex is officially backed by GAT Investment Bank (Malaysia), with a $10 million strategic investment.

GAT is a licensed and regulated institution.

User funds are custodied in separate bank accounts, ensuring safety and transparency.

This banking partnership is rare in the crypto world—and it proves UniMex is built on a strong financial foundation.

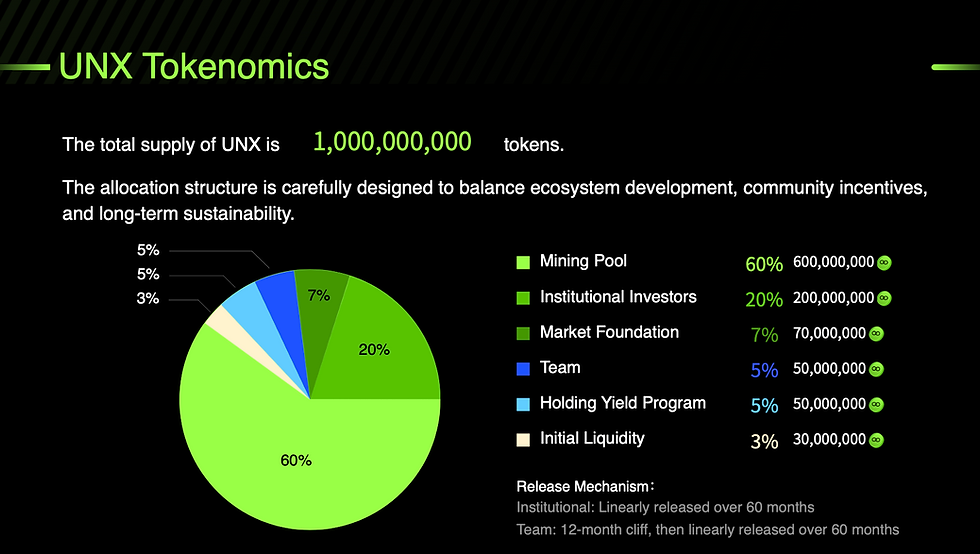

2. Transparent Tokenomics (UNX Token)

The UNX token is at the heart of UniMex. Unlike scam projects with hidden supply, UniMex has clear tokenomics:

Total Supply: 1,000,000,000 UNX.

Allocations: Mining (60%), Institutional Investors (20%), Market Foundation (7%), Team (5%), Holding Yield Program (5%), Initial Liquidity (3%).

Release Mechanisms: Vesting periods for institutions and team members, ensuring long-term commitment.

This transparency makes UniMex different from “pump-and-dump” tokens.

3. Deflationary Mechanisms to Protect Value

Scam tokens usually inflate supply endlessly. UniMex does the opposite, with a multi-dimensional burn system:

5% transaction fee burn on UNX sells.

10% burn on staking yields.

Buyback-and-burn program funded by platform revenue.

This ensures that the circulating supply decreases over time, supporting token value growth.

4. Real Earning Opportunities – Not False Promises

UniMex offers staking plans (Multiplier Ark) with realistic yet attractive yields:

30 Days: 12% monthly (144% annualized).

90 Days: 15% monthly (180% annualized).

180 Days: 19% monthly (228% annualized).

360 Days: 25% monthly (300% annualized).

Unlike scams that pay unsustainably, UniMex balances high yields with deflationary burns to maintain long-term sustainability.

5. Ecosystem Integration with UniLive

Scam projects usually operate in isolation. UniMex, however, is part of the UniLive ecosystem, which combines:

Short video and live-stream platforms.

NFT and gaming integration.

Content-driven user engagement that flows into trading and staking.

This dual-helix ecosystem makes UniMex more than just a finance app—it’s a complete Web3 experience.

6. Roadmap and Long-Term Vision

Scams disappear after a quick launch. UniMex has a clear, future-driven roadmap:

Growth of staking products and yield programs.

Expansion of Web3 applications: AI trading, cross-chain asset management, RWA (real-world assets).

Global compliance and user adoption goals for 2025–2028.

This long-term vision shows commitment, not short-term profit.

⚠️ Why Some People Still Doubt

High returns raise skepticism. But UniMex backs these with bank custody, structured tokenomics, and controlled burns.

New project: Being in early stages, UniMex is still earning global recognition, and like any startup, faces market adoption challenges.

But these doubts are natural for any disruptive innovation.

🧾 Final Verdict: UniMex is Real

With banking partnerships, transparent governance, deflationary economics, and ecosystem integration, UniMex is a legitimate project designed to last.

It is not a quick-cash scheme. It is a secure, long-term platform for users who want to explore the future of TradeFi and Web3 finance.

🎯 Closing Thoughts

If you’re considering UniMex, remember:

Always research before investing (DYOR).

Understand both the risks and rewards.

Start small, then grow as you gain trust.

Telegram: https://t.me/x365airdrop

Chat : +917020579836

Comments